macadamplus.ru

Maximize your home value. Whether its routine maintenance, emergency fixes, or a remodel. Chat with pros in your area to coordinate on project details and timing. No obligation. Affordable pros. Free estimates. April 11, - 17 reviews of Lingruen Associates "They were on time, and the person was very thorough, competent and professional. They found significant issues that another pest report company did not with the same property. Works for me.". Our San Francisco pest control company can help exterminate bed bugs, termites, rodents & more. Call HomeShield Pest Control for expert services near you. October 26, - Customer: I live in a 4 unit building in San Francisco, CA. My apartment was swarmed by flying termites last week. After speaking with a pest control expert on the phone and sending him a picture of one of the termites, he determined that they were dampwood termites most likely coming from inside the building. I told the building manager this and she said she would send the handyman to spot treat the area where they were most concentrated and call for an inspection. October 18, - Protect your San Francisco home from termites with expert inspections, treatments, and repairs by JK Termite Control Inc. June 8, - Like the other prominent micro-climates in the San Francisco area. The available services are listed below, but please feel free to browse our website for more information, or give us a call if there’s something we haven’t mentioned here that you think we might be able to help with: Termite Inspection & Treatments. September 7, - As with all of our services,MightyMite Termite Services will make sure to provide you with an accurate free quote and timeline for your project. To find out more about our services and get a free estimate, call ! Servicing San Jose, Santa Clara County, Alameda County, Santa Cruz County, San Mateo County, Monterey County, Marin County, Contra Costa County, and San Benito County in Northern California. The inspection. Faves for The Hitmen Termite & Pest Control, Inc. from neighbors in San Rafael, CA. Welcome to The Hitmen Termite and Pest Control, founded in Napa California in We are a Full Service Pest control company providing Pest Control, Termite Control, and Tree and Lawn Health Care while. December 28, - West Valley Structural provides the South San Francisco, San Francisco, CA areas with termite inspection and home inspection services. Get more information for Marina Pest Control in South San Francisco, CA. See reviews, map, get the address, and find directions. Western Exterminator provides expert, professional pest control solutions for your home or business near San Francisco, CA. Contact our local office today! Specialties: Priceless Termite Control is here and pleased to provide you with all your Termite Service Needs throughout the entire SF Bay Area. Established in 3 weeks ago - They offer a variety of pest control and sanitation services. The company was recently acquired by Orkin. Same-day appointments. Year-round services. Comprehensive pest control for birds, spiders, termites, bed bugs, birds, wildlife, and more. Pest control for homes and businesses. Some customers have reported that Clark’s initial inspections aren’t. BBB helps consumers and businesses in the United States and Canada. Find trusted BBB Accredited Businesses. Get BBB Accredited. File a complaint, leave a review, report a scam. August 27, - Read real reviews and see ratings for San Francisco, CA pest exterminators for free! This list will help you pick the right pro pest exterminators in San Francisco, CA. People use Yelp to search for everything from the city's tastiest burger to the most renowned cardiologist. What will you uncover in your neighborhood? Terminix in San Francisco - Hayward CA, provides pest control services for termites, bed bugs, cockroaches, ants & more. Schedule a free inspection online! October 15, - Laureise Livingston shared the horrific nightmare her and her husband endured after purchasing a century old home about two years ago in a wooded area just outside of San Francisco, California. How the Landmark in San Francisco achieved BREEAM USA certification to demonstrate its sustainability performance. Pest Terminators Inc., Cape Coral, Florida. likes. Integrated Pest Management Company.

What can you do to prevent termite infestations in San Francisco - Call us at 1-888•718•9808

To support our service, we display Private Sponsored Links that are relevant to your search queries. These tracker-free affiliate links are not based on your personal information or browsing history, and they help us cover our costs without compromising your privacy. If you want to enjoy Ghostery without seeing sponsored results, you can easily disable them in the search settings, or consider becoming a Contributor. Reviews on Termite Inspection in MightyMite Termite Services, Hall Bros Termite Control, HomeSentry Inspections, Moore Home Group, Brothers Inspections Services . If you are worried that your San Francisco home has been infested by termites, call our San Francisco termite control company today at One of our licensed inspectors in San Francisco will complete a full inspection. . Great Wall Termite Control provides a wide range of termite control services for residential, commercial, and industrial clients in San Mateo, Santa C Read More Termite Control and Inspections, Full Structure Fumigation, Localized and Soil Treatments, Preventive Treatments, Related Wood . A lot of homes in the San Francisco Bay Area have unframed garage spaces with the framing exposed. This is an area that gives easy access to wood-destroying pests. The average cost of a termite inspection is $ for a single-family home and $ for a condominium inspection. . Call Orkin for a termite inspection immediately. Our inspectors implement effective San Francisco termite treatment and utilize the industry's latest technology, including moisture meters and IR thermometers, to pinpoint exactly where termites might be hiding and target them at the source. . Omega Termite and Pest Control has served the San Francisco Bay Area for over 30 years. Residential and Commercial. Termites, bed bugs, bees, rodents. . Termite inspection services in the San Francisco Bay Area. We assess your property for termite activity, expert recommendations to safeguard your investment against potential damage. . Clark Pest Control focuses on pest extermination services in San Francisco and the Peninsula. While it offers services to control a wide range of insect and animal infestations, Clark specializes in termite inspection and treatment and bed bug extermination. . However, when you work with ATCO, tag and scheduling stress to your plate when you work with us. Save 10% on bed bug treatment today! Here at ATCO Pest Control, we know just how destructive these termites can be. . If I find a well rated company they do not service San Francisco or use a sub contractor for fumigation that has terrible reviews. If anyone has ever had a fumigation in SF, can you please share your experience plus which company/subcontractor was used? I really liked Proven Termite’s reviews . If you enjoy Ghostery ad-free, consider joining our Contributor program and help us advocate for privacy as a basic human right.

Quality made in America durable coated canvas ID wallet key chain with leather patch to personalize with initials or monogram. . Our fan favorite is back with new designs! This durable wallet allows you to carry everything you need while staying small and compact. . Google Wallet is a safe way to store and use your cards, tickets, passes, keys, and IDs. Get started with Google Wallet. . Discover the Marni women's accessories collection on the official store. Shop online made in Italy wallets and small leather goods. . Order your handcrafted leather wallet today. Made in Maine from American cow hide, ORIGIN™ genuine leather wallets feature heavy-duty corded stitching for . Explore our vibrant collection of women's wallets in various colors and materials. Discover the perfect accessory for every occasion! . This sleek vegan-leather wallet effortlessly and securely attaches to your iPhone in a snap connection so you can conveniently carry your cards, ID, or even . Wallets & Card Holders · Wesport Tri Fold Wallet, CHOCOLATE Add to cart + Quick Shop · Wardville Pouch Wallet, CHOCOLATE Add to cart + Quick Shop · Wesport Tri . Get help finding a bitcoin wallet. Answer a few basic questions to create a list of wallets that might match your needs. .

Integrity Termite Inspection Reviews Hi there!Be the first to review! 5 First-class 4 Better than most 3 About what I expected 2 Not the worst 1 Disappointing Click to Rate Addr . CATEGORY: Termite Inspection Showing: 42 results for Termite Inspectionnear San Jacinto, CA Accurate Termite and Pest Control Alton Pkwy Ste , Irvine, CA A . CATEGORY: Termite Inspection Showing: 45 results for Termite Inspectionnear San Bernardino, CA Select businesses earn BBB Accreditation by undergoing a thorough evaluation and upho . CATEGORY: Termite Inspection Showing: 23 results for Termite Inspectionnear San Rafael, CA Select businesses earn BBB Accreditation by undergoing a thorough evaluation and upholdin . San Marcos Termite & Inspection Co Add to Favorites Be the first to review! Map & Directions Fm San Marcos, TX Reviews Hi there!Be the first to review! 5 First-class . Mar 2, - Termite Inspection Reports: Defined & Explained Disclaimer: We strive to provide objective, independent advice and reviews. When you decide to use a product or service we link to, . Find a termite inspector near San Antonio, TX Find a termite inspector near San Antonio, TX 1 near you Give us a few details and we’ll match you with the right pro. Reviews for Sa . Posted on Searching for the best Termite Treatment in South San Francisco Your local Termite Treatment in South San Francisco termite treatment South San Franci . Dec 9, - It is used as part of a termite inspection, monitoring, and baiting system. Also see general fact sheet (PDF)(3 pp, K) Hydramethylnon (PDF) (5 pp, K) - insecticide us . Termite Inspections in Washington D.C., Maryland & Virginia Termite Inspections in Washington D.C., Maryland & Virginia At American Pest our team understands the anticipation of bu . Termite Inspection in Las Cruces, NM YP - The Real Yellow Pages - helps you find the right local businesses to meet your specific needs. Search results are sorted by a combination . Termite Inspection in Dixon, IL YP - The Real Yellow Pages - helps you find the right local businesses to meet your specific needs. Search results are sorted by a combination of fa .

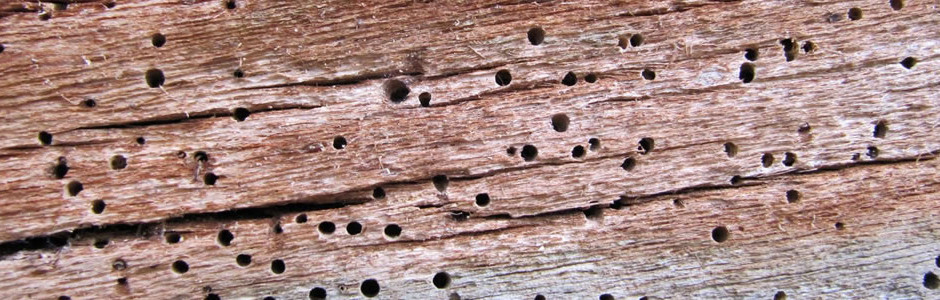

[Image If you own a house, commercial building, or any other property, you have to ensure you take the proper steps to maintain its condition. Termites, in particular, are known to be one of the top contributors to property damage as they can feed on anyth . Read our Blog: Termite problems are the biggest threat to property anywhere in the world. These small insects can cause unfathomable damage to woodwork. This means all windows, doors, and door jams in your home, not to speak of trees and plants in your ga . USA Classifieds Real Estate Home Improvements Page 31 ( sec) . Whether you’re looking to purchase or sell your home or commercial real estate, ensuring the property is pest-free is non-negotiable. That’s where MightyMite Termite comes in. Look to our termite control experts for full-stack WDO reports to obtain the WD . CONSUMER GUIDE market leaders pest control in San Francisco CA recommended termite control systems termidor, premise, exterra, sentricon termite. The Sleep Tight Group works with property management companies to detect, control, and prevent pest infestati . Post Views Trying to find a Pest control companies near you? Searching for the best Pest control companies in San Francisco, CA has to offer? If you find yourself in a situation where finding the best San Francisco, CA Moving companies gets difficult, . Related pages Select any title to view the full question and replies. RE Jul 8, ) When we had our foundation replaced (by Alameda Structural, who did a great job I believe they were able to do it without blocking the driveway we share with our neighbo . Rosemount Construction, 41st Ave, San Francisco, CA (Owned by: Brendan Fox) holds a according to the California license board. Their BuildZoom score of ranks in the top 2% of , California licensed contractors. Their license was verified as a . Terminix Termite Pest Control South San Francisco (CA ) deals with mosquito control, termite inspection, termite control and bug exterminator. It is a United States-based company founded in It is located at Dubuque Ave S, South San Francisc . Spring is on the way and whether you are considering selling your or you just want to make it nicer to live in, here are five things you can do to make it more valuable and livable. If you want your home to be more valuable and sell faster, it doesn’t nec . Whereorg has results under Nonclassifiable establishments Companies in the United States. Narrow down the browsing criteria below to see more companies. . CONSUMER GUIDE market leaders pest control in San Francisco CA recommended termite control systems termidor, premise, exterra, sentricon termite baits . Answer a few questions and we'll get you free estimates from local businesses. . Sorry, we were unable to verify your service address If this is the correct address, please continue as is to resubmit, otherwise you may edit your address and try again. . Dubuque Avenue, San Francisco, CA out of 5 Features Services: Cost: Customer Reviews: Terminix began as a targeted termite control company. Though it still offers some of the best termite treatments in the industry, its expanded services incl . The resource discusses the benefits of regular inspections, monitoring, and seasonal maintenance work; provides general guidance on maintenance treatments for historic building exteriors; and emphasizes the importance of keeping a written record of comple . We may be compensated if you purchase through links on our website. Our Reviews Team is committed to delivering honest, objective, and independent reviews on home products and services. . Business Name: G And M And Inspection Co Categorized In: Termite Control Address: G M Inspection Co, San Francisco, CA Phone Number: Contact Person: Gary Turner NAICS Code: SIC Code: Business Type: B2B (Business to Business) Founding Yea . No matter how long you’ve lived in your home, there's no escaping the occasional repair or improvement project. From small problems you can fix yourself to major concerns requiring the help of a pro, it takes valuable time and money to keep your house in . HiTech Termite Control use today’s most advanced technologies to control and eliminate termite problems. Hi Tech's microwave technology is clean and efficient. Microwaving in conjunction with state registered chemicals, such as non-repellant Termidor, to . Julio Nieto, a retrofit specialist, uses a pneumatic palm nailer to anchor a wood-frame house in Palo Alto to its foundation. Thomas Anderson/Anderson-Niswander Construction By Editorand Reporter It will take at least 7 years to secure older woo . (Click on a letter to fetch an alphabetic section Towing, 24h Towing And Roadside Assistance in Fresno, CA, Towing, Call Cars Towing, a trusted tow truck operator, whenever you need professional roadside help solutions, including a flat tire change, a gas . Advertiser Disclosure Our editorial team is committed to creating independent and objective content focused on helping our readers make informed decisions. To help support these efforts we receive compensation from companies that advertise with us. The co . A commercial, cultural, and financial hub of the United States, is filled with avenues of opportunity and adventure. Whether you’re on a drive past The Painted Ladies or hiking one of the scenic trails on the Twin Peaks, it’s easy to understand why over 8 . Affiliate Disclosure THIS PAGE MAY CONTAIN AFFILIATE LINKS, MEANING WE RECEIVE A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE VIA OUR LINKS, THERE IS NO COST TO YOU PLEASE READ OUR FOR MORE INFO THANK YOU! Posted on Looking for the best .