macadamplus.ru

Community

How Much Mortgage Can I Comfortably Afford

How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Find out how much home you can afford on your salary. Your recommended budget should be a comfortable fit within your overall finances. You should aim to keep. No more than 30% to 32% of your gross annual income should go to mortgage expenses, such as principal, interest, property taxes, heating costs and condo fees. How Much House can I Afford? If you make a down payment below 20% of the home price, you may be required to purchase Private Mortgage Insurance (PMI). What's. This rule states that your mortgage payment (including principal, interest, insurance, and taxes) should not exceed 28% of your total monthly gross income (your. Below is how much house you can afford. Your monthly payment. Expect a home at this price to fit comfortably within your budget. Your Custom Mortgage is Here. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment. This video shows you how your mortgage payment should fit comfortably into your lifestyle. Learn more about how much mortgage you can afford. Find a down. Use our mortgage affordability calculator to see how your interest rate, down payment and debt ratios affect your housing budget. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Find out how much home you can afford on your salary. Your recommended budget should be a comfortable fit within your overall finances. You should aim to keep. No more than 30% to 32% of your gross annual income should go to mortgage expenses, such as principal, interest, property taxes, heating costs and condo fees. How Much House can I Afford? If you make a down payment below 20% of the home price, you may be required to purchase Private Mortgage Insurance (PMI). What's. This rule states that your mortgage payment (including principal, interest, insurance, and taxes) should not exceed 28% of your total monthly gross income (your. Below is how much house you can afford. Your monthly payment. Expect a home at this price to fit comfortably within your budget. Your Custom Mortgage is Here. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment. This video shows you how your mortgage payment should fit comfortably into your lifestyle. Learn more about how much mortgage you can afford. Find a down. Use our mortgage affordability calculator to see how your interest rate, down payment and debt ratios affect your housing budget.

A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. It's best to keep your mortgage payment around 25% of your overall monthly budget. Your prequalification amount is how much of a mortgage you could be approved. How Much House can I Afford? If you make a down payment below 20% of the home price, you may be required to purchase Private Mortgage Insurance (PMI). What's. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. This includes not just your mortgage payments but other expenses like home insurance, property taxes, and private mortgage insurance (PMI) if you're required to. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. It's best to keep your mortgage payment around 25% of your overall monthly budget. Your prequalification amount is how much of a mortgage you could be approved. To calculate this percentage, multiply your gross monthly income by For example, if your gross monthly income is $5,, your housing expenses should not. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. At most, you may be able to afford a $1, monthly mortgage payment. Check your credit score. You'll need good credit to qualify for a mortgage loan. And the. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. As noted in our 28/36 DTI rule section above, multiplying your gross monthly income by is a good rule of thumb for a max target mortgage payment, including. Your total housing costs should not be more than 28% of your gross monthly income. Your total debt payments should not be more than 36%. Debt-to-income-ratio . Understanding how much mortgage you can afford · How much a mortgage lender will qualify you to borrow, based on your income, debt and down payment savings · How. Generally speaking, you can afford a home if no more than % of your total income is used to pay debts. Lenders will help you determine - and then take a. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Many people will tell you that the rule of thumb is you can afford a mortgage that is two to two-and-a-half times your gross (aka before taxes) annual salary.

How To Get Low Interest Home Loan

Mortgage rates stabilized this week, averaging % for year fixed loans, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. Ideal choice for servicemembers, reservists and Veterans who have already exhausted their VA loan benefit. Interest rate as low as. %. APR as low as. Try to find banks that are in distress or not very well known credit unions. Remember banks take there sweet time with loans whereas brokers are. It looks like your browser does not have JavaScript enabled. Please turn on JavaScript and try again. Close Search. Menu SubMenu. Home Loans · Apply Now · Why. 7 ways to get a lower mortgage rate · 1. Shop for mortgage rates · 2. Improve your credit score · 3. Choose your loan term carefully · 4. Make a larger down payment. Additionally, most are conforming loans with county-specific loan limits set by the Federal Housing Finance Agency (FHFA) and have lower interest rates than non. 1. Bi-weekly mortgage payments · 2. Extra mortgage payments · 3. Drop Private Mortgage Insurance (PMI) · 4. Recast your mortgage · 5. Streamline refinance · Key. No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage Insurance (PMI) · The VA home loan is a lifetime. Let us help find the home loan that's right for you. Our home loans — and low home loan rates — are designed to meet your specific home financing needs. Mortgage rates stabilized this week, averaging % for year fixed loans, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. Ideal choice for servicemembers, reservists and Veterans who have already exhausted their VA loan benefit. Interest rate as low as. %. APR as low as. Try to find banks that are in distress or not very well known credit unions. Remember banks take there sweet time with loans whereas brokers are. It looks like your browser does not have JavaScript enabled. Please turn on JavaScript and try again. Close Search. Menu SubMenu. Home Loans · Apply Now · Why. 7 ways to get a lower mortgage rate · 1. Shop for mortgage rates · 2. Improve your credit score · 3. Choose your loan term carefully · 4. Make a larger down payment. Additionally, most are conforming loans with county-specific loan limits set by the Federal Housing Finance Agency (FHFA) and have lower interest rates than non. 1. Bi-weekly mortgage payments · 2. Extra mortgage payments · 3. Drop Private Mortgage Insurance (PMI) · 4. Recast your mortgage · 5. Streamline refinance · Key. No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage Insurance (PMI) · The VA home loan is a lifetime. Let us help find the home loan that's right for you. Our home loans — and low home loan rates — are designed to meet your specific home financing needs.

Meet with several lenders. You don't have to go with the first lender quote you receive. You can shop around to find the best loan to fit your needs—research. A higher credit score helps you qualify for a lower mortgage rate, and with more money you can make a bigger down payment. By paying more upfront you can avoid. You may be able to put as little as 3% down on a fixed-rate conventional mortgage with a rate that's locked for the life of your loan. As a direct lender, loanDepot has access to low rate home loans, and we can help make the process of financing a home fast and easy. Loans are arranged for up to 20 years at 1 percent interest. Grants may be arranged for recipients who are 62 years of age or older and can be used . Try to find banks that are in distress or not very well known credit unions. Remember banks take there sweet time with loans whereas brokers are. Generally speaking, these five factors play a major role in determining whether you qualify for a home loan, how much you can borrow, and at what interest rate. You can negotiate a lower mortgage rate by offering to pay mortgage points. Each point is equal to 1% of your loan amount. If you're getting a $, mortgage. Similarly, you can split the loan amount between a first and second mortgage. This may result in lower monthly payments due to potentially lower rates available. MaineHousing's First Home Loan Program makes it easier and more affordable to buy a home of your own by providing low fixed interest rate mortgages. Mortgage rates stabilized this week, averaging % for year fixed loans, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. The total cost of your loan, including interest and mortgage insurance; How loans have unique characteristics that make them ineligible to be a qualified. Adjustable-rate mortgages, or ARMs, are a less-common alternative that can grant you a lower initial mortgage rate for the first few years of the loan. With a. See our current refinance rates and compare refinance options. Affordability. Our affordable lending options, including FHA loans and VA loans, help make. Answer a few questions about your loan preferences to compare mortgage rates from multiple lenders. Where are you buying/refinancing? Get started. Rates can. lower interest rate for an initial portion of the loan term. Most ARMs have a rate cap that limits the amount of interest rate change allowed during both. This program assists low- and very-low-income applicants obtain Fixed interest rate based on current market rates at loan approval or loan closing, whichever. Borrowers have the option to buy down their interest rate by purchasing discount points. When you purchase discount points, you are essentially paying interest. Best-in-class mortgage options built around you. Mortgage Refinance. Refinancing could help you save money with a shorter term, lower rate, or lower monthly. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing.

Immediately Improve Your Credit Score

How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. How to improve your credit scores: 7 tips that can help · Monitoring your credit can give you an idea of your creditworthiness. · Making payments on time, keeping. In this article: · 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the Types of Credit You. Dispute any errors that you find. This is the closest you can get to a quick credit fix. A Consumer Reports study found that 34% of consumers have at least one. Boost your Credit Scores and raise your FICO® Score instantly for free. Millions of points already boosted across America. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit. How to improve your credit scores: 7 tips that can help · Monitoring your credit can give you an idea of your creditworthiness. · Making payments on time, keeping. In this article: · 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the Types of Credit You. Dispute any errors that you find. This is the closest you can get to a quick credit fix. A Consumer Reports study found that 34% of consumers have at least one. Boost your Credit Scores and raise your FICO® Score instantly for free. Millions of points already boosted across America. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4.

Learn the basics of how to build credit, how to use credit cards and practice positive credit behavior. Here are six ways to elevate your credit score, from those that can produce fast results to ones that require a slow and steady approach. Credit scores are measured on several factors, including your credit mix and how well you manage a mix of credit, balances, payments, etc. Another way to increase your credit score is to pay your bills, credit cards and lines of credit on time. This means paying BEFORE the due date—not waiting. Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a credit limit. Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a credit limit. While a poor credit score can certainly make life more difficult, don't get discouraged. While increasing your score takes time, even small steps will help you. Keep old accounts open: Closing old accounts can lower your credit score, so try to keep them open if possible. 1. PAY YOUR BILLS ON TIME Paying your bills on time is one of the easiest things you can do to consistently improve your credit score. Many credit-scoring models consider the number and type of credit accounts you have. A mix of installment loans and credit cards may improve your score. However. Pay down your highest interest credit cards first, leave yourself some money, even a small amount for any possible shortfalls that you might. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close unused. A sure-fire way of paying bills on time is by setting recurring payments on "auto pay" in your online banking account. Building a good credit score · Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card. Here are six ways to elevate your credit score, from those that can produce fast results to ones that require a slow and steady approach. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. Trying to raise your credit score? · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Pay your credit cards more than once a. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score.

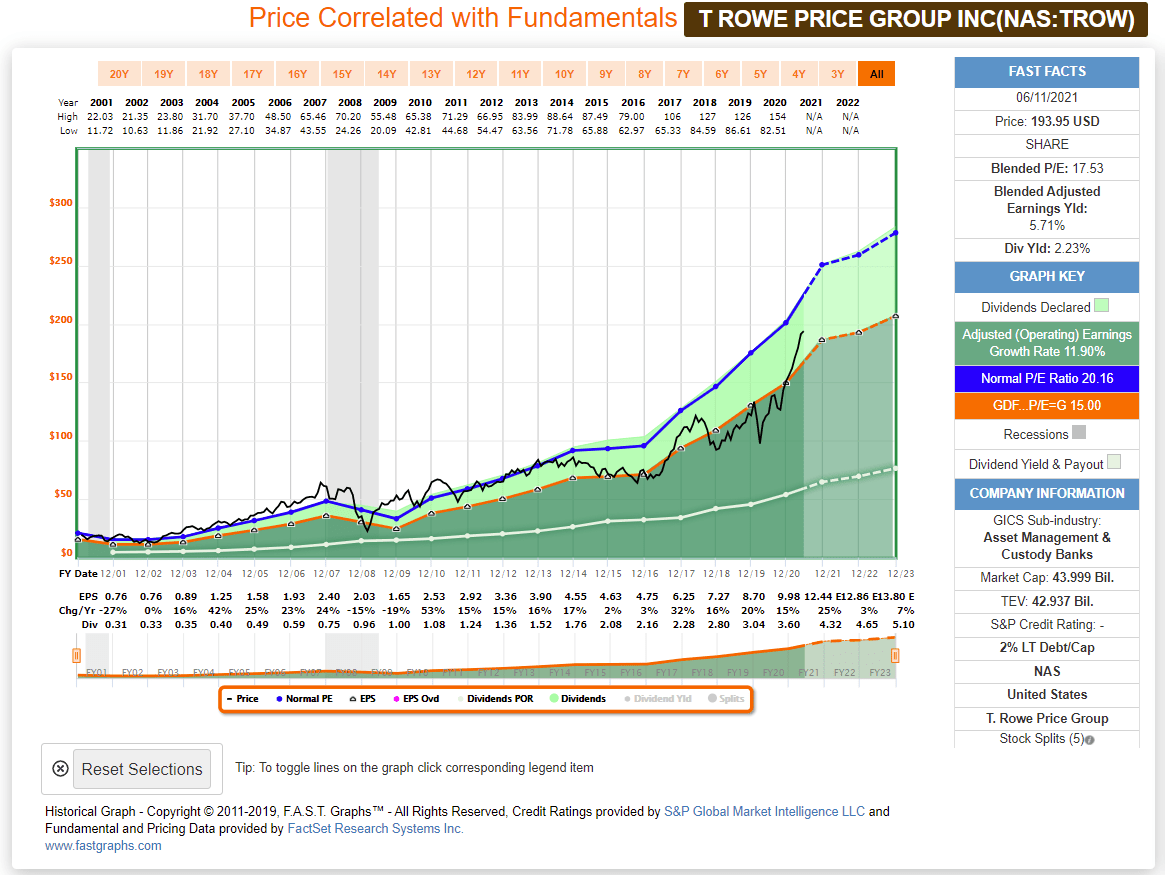

T Rowe 2040 Fund

Analyze the Fund T. Rowe Price Retirement Blend Fund having Symbol TRBLX for type mutual-funds and perform research on other mutual funds. RRTDX | A complete T Rowe Price Retirement Fund;R mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Investment Objective. The fund seeks the highest total return over time consistent with an. T. Rowe Price Retirement Fund Military weapon grade: Fund is invested in military contractors above the threshold of % and below the threshold of 4%. Rowe Price Retirement Fund – I Class is managed by T. Rowe Price Group, Inc. of Baltimore, Maryland. Investment Objective. The objective is to provide the. MassMutual Select T. Rowe Price Retirement Fund $MMFPX is % ($ MILLION) invested in gun manufacturer and major gun retailer stocks. The fund seeks to provide the highest total return over time, consistent with an emphasis on capital growth, as well as income. The fund invests in a. View more fund info. MassMutual Select T. Rowe Price Retirement Fund earns a D grade for investments in military weapons. Tweet. Invest Your Values. Analyze the Fund T. Rowe Price Retirement Blend Fund having Symbol TRBLX for type mutual-funds and perform research on other mutual funds. Analyze the Fund T. Rowe Price Retirement Blend Fund having Symbol TRBLX for type mutual-funds and perform research on other mutual funds. RRTDX | A complete T Rowe Price Retirement Fund;R mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Investment Objective. The fund seeks the highest total return over time consistent with an. T. Rowe Price Retirement Fund Military weapon grade: Fund is invested in military contractors above the threshold of % and below the threshold of 4%. Rowe Price Retirement Fund – I Class is managed by T. Rowe Price Group, Inc. of Baltimore, Maryland. Investment Objective. The objective is to provide the. MassMutual Select T. Rowe Price Retirement Fund $MMFPX is % ($ MILLION) invested in gun manufacturer and major gun retailer stocks. The fund seeks to provide the highest total return over time, consistent with an emphasis on capital growth, as well as income. The fund invests in a. View more fund info. MassMutual Select T. Rowe Price Retirement Fund earns a D grade for investments in military weapons. Tweet. Invest Your Values. Analyze the Fund T. Rowe Price Retirement Blend Fund having Symbol TRBLX for type mutual-funds and perform research on other mutual funds.

Fund Details. Fund Strategy. The investment seeks the highest total return over time consistent with an emphasis on both capital growth and income. The fund. Objective. The investment seeks the highest total return over time consistent with an emphasis on both capital growth and income. The fund invests in a. Performance charts for T Rowe Price Target Retirement Fund (TRHRX) including intraday, historical and comparison charts, technical analysis and trend. be a mix of stocks/stock funds and bonds/bond funds. In general, bond prices fall when interest rates rise and vice versa. macadamplus.ru Price Retirement Fund. Fund Objective. The Fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. Investment Overview. Objective. The investment seeks the highest total return over time consistent with an emphasis on both capital growth and income. The fund operates under a ". The underlying fund pursues its objective by investing in a diversified portfolio of other T. Rowe Price stock and bond funds that represent various asset. MassMutual Select T. Rowe Price Retirement Fund Deforestation grade: Fund is invested in deforestation-risk agricultural commodity producer/traders. Rowe Price Retirement Trust (Class G) Fund. %. 08/22/ T. Rowe Price Retirement Fund · Fossil fuel finance · Commercial and investment banks' carbon-intensive funding is fundamentally incompatible with reaching. The Fund is designed for an investor who retires at or about the target date and who plans to withdraw the value of the account in the Fund gradually after. Latest T. Rowe Price Retirement Fund (TRRDX) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile. The fund pursues its objective by investing in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes. On a five-year basis, the T. Rowe Price Retirement Fund tops the list in its Morningstar category, in terms of total return. However, investors should keep. T. Rowe Price Retirement Fund (09/02). TRRDX. BlackRock LifePath® Index Fund Investor A Shares. (05/11). LIKAX. MassMutual Select T. Rowe Price Retirement Fund · 1. Microsoft Corp. Prison industry Border industry. $M. % · 2. macadamplus.ru Inc. Prison industry. Find the latest performance data chart, historical data and news for T. Rowe Price Retirement Fund (TRRDX) at macadamplus.ru Get T. Rowe Price Retirement Fund (TRRDX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Get the latest T. Rowe Price Retirement Fund (TRRDX) real-time quote, historical performance, charts, and other financial information to help you make. TRRDX (Mutual Fund). T. Rowe Price Retirement Fund. Payout Change. Pending. Price as of: AUG 19, PM EDT. $ + +%. primary theme. Target-.

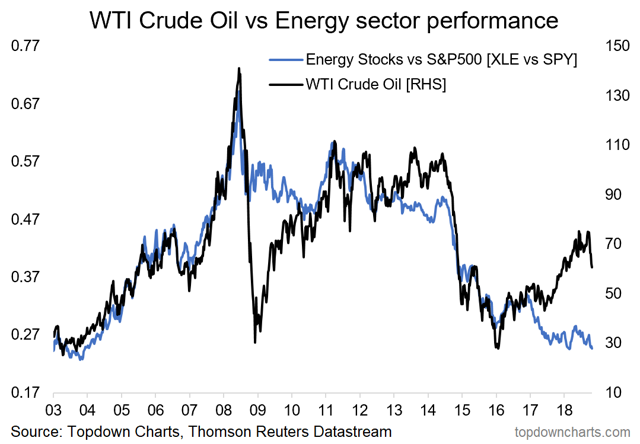

How Much Are Oil Stocks Right Now

Historical Prices for Oil (Brent) ; 09/13/24, , ; 09/12/24, , ; 09/11/24, , ; 09/10/24, , market and provides an outlook for crude oil market developments for the coming year. Oil Market Report is now more accessible than ever. As of March Follow today's crude oil price moves and key news stories driving oil price actions, as well as developments in the broader energy sector. Best Crude Oil Stocks ; Exxon Mobil (NYSE:XOM) · · M / M · B ; Chevron (NYSE:CVX) · · M / M · B ; Sunoco (NYSE:SUN). Crude Oil WTI (NYM $/bbl) Front Month ; Day Range - ; 52 Week Range - ; Open Interest , ; 5 Day. % ; 1 Month. %. We want to hear from you. Get In Touch. CNBC Newsletters. Sign up for free newsletters and get more CNBC delivered to your inbox. Sign Up Now. Oil & Gas Production Stocks ; Vista Energy S.A.B. de C.V - ADR VIST · $ ; Gulfport Energy Corp. - Ordinary Shares (New) GPOR · $ ; Diamondback Energy Inc. Oil and Gas Stocks ; ServiceNow, Inc. stock logo. NOW. ServiceNow. $ %, ; TotalEnergies SE stock logo. TTE. TotalEnergies. $ +%, Best Oil Stocks Right Now ; Texas Pacific Land (NYSE:TPL) · $ ; TotalEnergies (NYSE:TTE) · $ ; EOG Resources (NYSE:EOG) · $ ; Baker Hughes (NASDAQ:BKR). Historical Prices for Oil (Brent) ; 09/13/24, , ; 09/12/24, , ; 09/11/24, , ; 09/10/24, , market and provides an outlook for crude oil market developments for the coming year. Oil Market Report is now more accessible than ever. As of March Follow today's crude oil price moves and key news stories driving oil price actions, as well as developments in the broader energy sector. Best Crude Oil Stocks ; Exxon Mobil (NYSE:XOM) · · M / M · B ; Chevron (NYSE:CVX) · · M / M · B ; Sunoco (NYSE:SUN). Crude Oil WTI (NYM $/bbl) Front Month ; Day Range - ; 52 Week Range - ; Open Interest , ; 5 Day. % ; 1 Month. %. We want to hear from you. Get In Touch. CNBC Newsletters. Sign up for free newsletters and get more CNBC delivered to your inbox. Sign Up Now. Oil & Gas Production Stocks ; Vista Energy S.A.B. de C.V - ADR VIST · $ ; Gulfport Energy Corp. - Ordinary Shares (New) GPOR · $ ; Diamondback Energy Inc. Oil and Gas Stocks ; ServiceNow, Inc. stock logo. NOW. ServiceNow. $ %, ; TotalEnergies SE stock logo. TTE. TotalEnergies. $ +%, Best Oil Stocks Right Now ; Texas Pacific Land (NYSE:TPL) · $ ; TotalEnergies (NYSE:TTE) · $ ; EOG Resources (NYSE:EOG) · $ ; Baker Hughes (NASDAQ:BKR).

Oil stocks can also be effective hedges against inflation, as higher crude oil prices boost energy sector margins. Oil Price Charts ; WTI Crude, , + ; Brent Crude, , + ; Murban Crude, , + ; Natural Gas, , + ; Gasoline, , + Get Crude Oil Front Month Futures (CLc1) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Exxon Mobil's stock price is currently $, and its average month price target is $ Crude oil prices & gas price charts. Oil price charts for Brent Crude, WTI & oil futures. Energy news covering oil, petroleum, natural gas and investment. Get the latest Crude Oil price (CL:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. Just Now; 9 · Oil prices climb on hurricane impact ahead of US rate decision Just Now; 3 · Tech stocks drag, dollar plumbs lows on rate cut expectations. By. In order to find the best oil stocks to buy now, we started by screening the S&P 's oil & gas sector for Wall Street analysts' top-rated names. Saudi Aramco Is Selling Shares. Why It Trades Differently Than Most Oil Stocks. April 12, p.m. ET. Plastic Is Everywhere. Now Big. XOM | Complete Exxon Mobil Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. *Note: Crude oil price in dollars per barrel. Futures Prices after April 5, , are not available. Stocks (million barrels). Investing in Oil Stocks: Top Oil Stocks to Buy · ConocoPhillips is one of the largest E&P-focused companies in the world. · Devon Energy is a U.S.-focused E&P. Oil Stocks News ; $SPX · 5, (+%) ; SPY · (+%) ; $DOWI · 41, (+%) ; DIA · (+%) ; $IUXX · 19, (%). Crude Oil is expected to trade at USD/BBL by the end of this quarter, according to Trading Economics global macro models and analysts expectations. XOM | Complete Exxon Mobil Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes Before it's here, it's on the Bloomberg Terminal. Equinor ASA's stock price is currently at $, showing stability and potential for growth in the market. Equinor ASA reported a strong return on equity of. Average price paid for oil in the Reserve - $ per barrel. Drawdown stocks for 2 million barrel Northeast Home Heating Oil Reserve. June Oil and gas stocks were up % in the last day, and up % over the last week. We couldn't find a catalyst for why oil and gas stocks are up. Equinor ASA's stock price is currently at $, showing stability and potential for growth in the market. Equinor ASA reported a strong return on equity of.