macadamplus.ru

Tools

Dissolved Company Meaning

So how does a company cease to exist? Corporate dissolution is the process that must take place to end a business organization cleanly. To unlock this lesson. As used in this subsection, “subsidiary” means any entity wholly-owned and controlled, directly or indirectly, by the corporation and includes, without. Dissolution of corporation refers to the closing of a corporate entity which can be a complex process. Ending a corporation becomes more complex with more. A dissolved legal entity does not immediately cease to exist, unless there is no capital at the time of dissolution. Is there any capital? In that case, debts. Application for Reinstatement Following Administrative Dissolution A limited liability company that was administratively dissolved by the Division may apply. Termination (dissolution) of a Washington corporation or other Entity by the Secretary of State because the entity failed to meet a requirement in statute, such. Bankruptcy is a legal means by which This means that: should the dissolved company be sued, the lawsuit will be brought against the shareholder;. The short answer is that a company dissolution is when a company winds down its operations and then shuts down for good. When a company is. When a company is dissolved, it means that it has been legally and formally closed down. This process involves the removal of the company from the Companies. So how does a company cease to exist? Corporate dissolution is the process that must take place to end a business organization cleanly. To unlock this lesson. As used in this subsection, “subsidiary” means any entity wholly-owned and controlled, directly or indirectly, by the corporation and includes, without. Dissolution of corporation refers to the closing of a corporate entity which can be a complex process. Ending a corporation becomes more complex with more. A dissolved legal entity does not immediately cease to exist, unless there is no capital at the time of dissolution. Is there any capital? In that case, debts. Application for Reinstatement Following Administrative Dissolution A limited liability company that was administratively dissolved by the Division may apply. Termination (dissolution) of a Washington corporation or other Entity by the Secretary of State because the entity failed to meet a requirement in statute, such. Bankruptcy is a legal means by which This means that: should the dissolved company be sued, the lawsuit will be brought against the shareholder;. The short answer is that a company dissolution is when a company winds down its operations and then shuts down for good. When a company is. When a company is dissolved, it means that it has been legally and formally closed down. This process involves the removal of the company from the Companies.

When A Company Is Dissolved, What Does It Mean? When a company is dissolved, it means that it has been legally and formally closed down. This process involves. If the mail cannot be delivered, the entity name is published in a Notice of Administrative Dissolution. If DFI does not receive an annual report within a given. companies? Summary chart for terminating a Texas entity; My certificate dissolved. (If you are an entity's registered agent, you may wish to consult. Businesses that fail to pay their Business Entity Report or maintain a registered agent will be administratively dissolved/revoked. Read on to learn more, and. Dissolving is the process of removing or “striking off” a company from the register at Companies House. In situations where a company has become surplus to. Foreign Limited Liability Companies and voluntarily dissolved entities cannot file for reinstatement. Domestic and Foreign Business Corporations. Dissolution is the end of the legal existence of a corporation. It usually occurs after liquidation, which is the process of paying debts and distributing. Dissolved companies have gone through the liquidation process, meaning they have been removed from the Companies House register. The dissolved company and the. When your company was formed it was added to the Companies House register of companies. When we talk about a company being dissolved we're referring to the. Corporation dissolution could be voluntary or involuntary. Involuntary dissolution may occur by a court decree or for administrative reasons, such as when the. The process of dissolving a · Corporations that have dissolved are generally prohibited from conducting any type of business except for winding up its affairs. In short, dissolving a company means a company is removed or 'struck off' the Companies House register. Learn more about the process here. A company dissolution is the act of a company being removed – or struck off – from the Companies House register. Once a company has been dissolved. A limited liability company is dissolved and its affairs shall be wound up when any of the following occurs: Upon dissolution of a limited liability company. That means you could no longer sue it, but over time at least two exceptions to this rule have evolved. Exception One: The Company Failed to Dissolve Properly. Once the business has been liquidated, an Insolvency Practitioner will then proceed to dissolve the company from the Companies House register, meaning it will. Dissolution is the last stage of liquidation, the process by which a company (or part of a company) is brought to an end, and the assets and property of the. Administrative dissolution by the Secretary of State for unpaid fees. This can happen even if the company has enough money to pay fees, but someone forgets to. If a corporation is no longer in business, it can be dissolved by filing the Articles of Dissolution (Form DC) with the department. A corporation is. As used in this subsection, “subsidiary” means any entity wholly-owned and controlled, directly or indirectly, by the corporation and includes, without.

Private Dental Insurance Colorado

An affordable plan that rewards members for maintaining dental coverage by reducing the patients cost sharing over a three year period - up to a $2, annual. At Colorado Dental Group, we honor major insurance plans, including Delta Dental. Since we are preferred providers and in-network with Delta Dental. You can shop for dental plans by calling us at: Individuals and families can choose from 12 dental plans offered by four carriers. Dental insurance helps you plan for the costs of dental care. Find individual dental insurance plans near you with budget-friendly coverage options and get. CSU offers two dental plans: Delta Dental Basic and Delta Dental Plus. Both plans are self-insured and administered by Delta Dental of Colorado. Delta Dental. CU's two Delta Dental plans — Essential Dental and Choice Dental — offer extensive coverage with affordable [glossary taxonomy="ES Benefits Glossary". How much is dental insurance in Colorado? The average dental insurance premium in Colorado is $ per month. *This is the based on average pricing for plans. We offer two networks: Delta Dental PPO™ and Delta Dental Premier®. Your network options will depend on your benefit plan. Before you schedule your next dentist. Our dental plans help you maintain a healthy smile through regular preventive dental care and offer coverage to fix problems early. An affordable plan that rewards members for maintaining dental coverage by reducing the patients cost sharing over a three year period - up to a $2, annual. At Colorado Dental Group, we honor major insurance plans, including Delta Dental. Since we are preferred providers and in-network with Delta Dental. You can shop for dental plans by calling us at: Individuals and families can choose from 12 dental plans offered by four carriers. Dental insurance helps you plan for the costs of dental care. Find individual dental insurance plans near you with budget-friendly coverage options and get. CSU offers two dental plans: Delta Dental Basic and Delta Dental Plus. Both plans are self-insured and administered by Delta Dental of Colorado. Delta Dental. CU's two Delta Dental plans — Essential Dental and Choice Dental — offer extensive coverage with affordable [glossary taxonomy="ES Benefits Glossary". How much is dental insurance in Colorado? The average dental insurance premium in Colorado is $ per month. *This is the based on average pricing for plans. We offer two networks: Delta Dental PPO™ and Delta Dental Premier®. Your network options will depend on your benefit plan. Before you schedule your next dentist. Our dental plans help you maintain a healthy smile through regular preventive dental care and offer coverage to fix problems early.

Group dental insurance policies featuring the Preferred Dentist Program are underwritten by Metropolitan Life Insurance Company, New York, NY Dental. Dental services are a program benefit for enrolled Health First Colorado (Colorado's Medicaid program) members of all ages. Discover affordable dental insurance plans at Delta Dental. Get coverage for preventive, basic, and major dental services. Protect your smile today! Looking for dental insurance? Good idea! After all, oral health is important to overall health and wellness.¹ So, whether you want coverage for yourself, your. From budget-friendly monthly premiums to low office-visit copays, Humana has a dental plan that is sure to fit your needs. View plans and prices available in. Your Smile is Powerful. It Deserves Delta Dental. We have a dental plan that fits your needs and budget. Shop Plans, Access Account, Get the latest oral. The Connect for Health Colorado marketplace offers children's dental benefits in two ways: 1. Through a "stand-alone" dental plan that is separate from your. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. Health First Colorado (Colorado's Medicaid dental plan) is a public health assistance program for Coloradans who qualify. Delta Dental individual dental insurance. Delta Vision individual vision insurance. View our cost-effective choices for dental and vision plans and get an. How much does dental insurance cost in Colorado? Premiums range from $0 to $ per month for adults who purchase their own stand-alone or family dental. Save money on the dental care you need with an Anthem dental plan. Get coverage for cleanings, X-rays, and more. Find a plan for you and your family today. A healthy mouth benefits the whole body, so it's important to find the right dental insurance plan. Learn more about Aetna's individual and family dental. Individual dental insurance plans · Delta Dental PPO™. Delta Dental PPO is our preferred-provider option program. · Delta Dental Premier®. Delta Dental Premier is. Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia Administered by Humana Insurance Company. Individual Dental and Vision Plans. Humana. Cigna Healthcare Dental Insurance Plans · Low Deductible Plans. Lower-cost coverage for you and your family. Average monthly premiums8 starting at $ · High. This program provides additional dental coverage for students enrolled in the CU Anthem Gold Student Health Insurance Plan (SHIP) as well as basic dental. Dental coverage options in Denver, Colorado PPO, Preferred Provider Organization – Includes an annual deductible and annual maximum benefit and features lower. In the Marketplace, you can pick a health plan with or without dental benefits. If you pick a health plan without dental benefits, you can still get a separate. Its annual max is the highest among the plans we researched, at $2, Anthem also has great coverage for major dental care. In the first year, Anthem's.

Us Treasury 30 Year Bond Yield

Bonds at a Glance ; Electronic form only · 20 or 30 years · The rate is fixed at auction. It does not vary over the life of the bond. It is never less than %. 30 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Report, H. Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. This page provides monthly data & forecasts of the 30 year Treasury bill yield, the effective annualized return rate for Treasury debt with a constant year. 30 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Interactive chart showing the daily 30 year treasury yield back to The US Treasury suspended issuance of the 30 year bond between 2/15/ and 2/9/ United States Year Bond Yield ; Prev. Close: ; Day's Range: ; 52 wk Range: ; Price: ; Price Range: Bonds at a Glance ; Electronic form only · 20 or 30 years · The rate is fixed at auction. It does not vary over the life of the bond. It is never less than %. 30 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Report, H. Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. This page provides monthly data & forecasts of the 30 year Treasury bill yield, the effective annualized return rate for Treasury debt with a constant year. 30 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Interactive chart showing the daily 30 year treasury yield back to The US Treasury suspended issuance of the 30 year bond between 2/15/ and 2/9/ United States Year Bond Yield ; Prev. Close: ; Day's Range: ; 52 wk Range: ; Price: ; Price Range:

Yield Open% ; Yield Day High% ; Yield Day Low% ; Yield Prev Close% ; Price

Treasury Inflation-Protected Securities (TIPS) are available both as medium and long-term securities. They mature in 5, 10, or 30 years. Like bonds and notes. The current yield of United States 30 Year Government Bonds is %, whereas at the moment of issuance it was %, which means −% change. Over the. Yield · Mortgage Rates · · · 6 · %. United States Year Bond Yield price and volume ; 52 Week Range. ; Day Range. Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter. U.S. Treasury bonds. Why GOVT? 1. Exposure to U.S. Treasuries ranging from year maturities. 2. Low cost access to the broad U.S. Treasury market in a. In this example, consider a government bond issued on 30 June with a 10 year term. The principal of the bond is $, which means that on 30 June US 30 Year Bond Yield was percent on Friday September 6, according to over-the-counter interbank yield quotes for this government bond maturity. U.S. 10 Year Treasury Note ; Change 0/32 ; Change Percent % ; Coupon Rate % ; Maturity Aug 15, ; 5 Day. US 10 Year Note Bond Yield was percent on Friday September 6, according to over-the-counter interbank yield quotes for this government bond maturity. Find the latest Treasury Yield 30 Years (^TYX) stock quote, history, news and other vital information to help you with your stock trading and investing. Graph and download economic data for Market Yield on U.S. Treasury Securities at Year Constant Maturity, Quoted on an Investment Basis (DGS30) from. Monthly Statement of the Public Debt · Quarterly Refunding · Debt Management 30 Yr. 01/02/, N/A, N/A, N/A, N/A, N/A, N/A, N/A, N/A, N/A, , , 27 Series Market Yield on US Treasury Securities at Year Constant Maturity, Quoted on an Investment Basis. TMUBMUSD30Y | View the latest U.S. 30 Year Treasury Bond news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ. Open%. Day Range ; 52 Wk Range - Price ; Change24/ Change Percent ; Coupon Rate%. Maturity. Price Yield Calculator ; Modified Duration, years ; Spread of ACF Yield (%) over yr Treasury Yield (%) As of 09/06/24 is + 10 bps. Reasons to choose a US treasury bond, treasuries issued by the US government; features, benefits and risks of treasury bills from Fidelity. Track forward-looking risk expectations on Year Treasuries with the CME Group Volatility Index (CVOLTM), a robust measure of day implied volatility. Bonds ; ^TNX CBOE Interest Rate 10 Year T No. (%). ; ^TYX Treasury Yield 30 Years. (%). ; 2YY=F 2-Year.

Saving A Lot Of Money

Add ''saving money" to your to-do list—and feel good while doing it · Consider starting with a number in mind · Change your “how to save money” mindset · Make. Why you earn a lot but aren't saving money! · The reasons you aren't saving as much as you should · The High Cost of Living and Lifestyle Inflation · Lack of. 10 Best Ways to Save Money · 1. Eliminate Your Debt · 2. Set Savings Goals · 3. Pay Yourself First · 4. Stop Smoking · 5. Take a Staycation · 6. Spend to Save · 7. If you can't do this monthly, then try for once every couple of months. It will still save you a lot of money. You can stockpile all kinds of non-perishable. “A lot will say OK, I can wait two months to get my sneakers,” Brown says. Finally, an additional resource for grown-ups. For more context on the wage gap, we. Boost your savings · 1. Take the 1p savings challenge · 2. Try a 'no spend' weekend · 3. About to splurge? · 4. Put strangely-shaped veg in your supermarket trolley. Establish your budget. The best way to jumpstart establishing a budget is to realize your spending habits. On the first day of a new month, get a receipt for. A simple way to guarantee that you save is to set up your bank account to automatically set aside a certain percentage of your income for savings. These options. The general rule is to have three to six months' worth of living expenses (rent, utilities, food, car payments, etc.) saved up for emergencies, such as. Add ''saving money" to your to-do list—and feel good while doing it · Consider starting with a number in mind · Change your “how to save money” mindset · Make. Why you earn a lot but aren't saving money! · The reasons you aren't saving as much as you should · The High Cost of Living and Lifestyle Inflation · Lack of. 10 Best Ways to Save Money · 1. Eliminate Your Debt · 2. Set Savings Goals · 3. Pay Yourself First · 4. Stop Smoking · 5. Take a Staycation · 6. Spend to Save · 7. If you can't do this monthly, then try for once every couple of months. It will still save you a lot of money. You can stockpile all kinds of non-perishable. “A lot will say OK, I can wait two months to get my sneakers,” Brown says. Finally, an additional resource for grown-ups. For more context on the wage gap, we. Boost your savings · 1. Take the 1p savings challenge · 2. Try a 'no spend' weekend · 3. About to splurge? · 4. Put strangely-shaped veg in your supermarket trolley. Establish your budget. The best way to jumpstart establishing a budget is to realize your spending habits. On the first day of a new month, get a receipt for. A simple way to guarantee that you save is to set up your bank account to automatically set aside a certain percentage of your income for savings. These options. The general rule is to have three to six months' worth of living expenses (rent, utilities, food, car payments, etc.) saved up for emergencies, such as.

1. Save what you can. Saving as a practice is not dependent on how much you earn. · 2. Save first. Save first, spend later. · 3. Open a savings account · 4. Start. " " It might be hard at first, but sticking to a budget can help you save a lot of money over time. Online banking makes it easier to figure out how much you'. 1. Save what you can. Saving as a practice is not dependent on how much you earn. · 2. Save first. Save first, spend later. · 3. Open a savings account · 4. Start. Consistently saving money allows you to engage in drama-free spending. But a lot of people find it challenging to save money. They set a goal to save a. Despite the significance of having savings, however, research shows that 45% of Americans have less than $1, saved — and in an emergency situation, $1, Practical Steps to Make Saving Money Easier · > Evaluate your household utility costs and budget: Can you save on water or electricity by using less? Are you. Your savings rate is the percentage of your income that you save, invest, or put toward debts. The higher your savings rate, the faster you build wealth. Sure. My encouragement to you would be to read this list and take action on at least one item today! If you really want to save a lot of money, you need to do lots of. In terms of personal finance, saving generally specifies low-risk preservation of money, as in a deposit account, versus investment, wherein risk is a lot. The importance of saving · 1. Switch to spend less on your utilities · 2. Change banks and get free cash · 3. Cancel unnecessary commitments · 4. Transfer debt to a. 14 ways to save money · Set specific savings goals · Create a monthly budget and stick to it · Bring a shopping list to the store · Try using cash for everyday. Maybe you are in debt from student loans or a fancy car. Whatever the case, never forget to save at least % of your after tax income while working and. The first step in saving is having a budget so you can understand how you're spending the money you earn with each paycheck. (There are lots of online templates. 10 Money Saving Tips · 1. Track your spending. · 2. Establish a budget. · 3. Set up savings goals. · 4. Use an automated tool. · 5. Prepare for grocery shopping in. The $20 Savings Challenge is an easy and fun money saving tip that can start you on the path to saving more money without even noticing! All you have to do is. Deposit a portion of your income in a savings or retirement account. Don't accumulate new debt, and pay off any debt you currently have. Separate and automate your savings · Look for ways to reduce spending · Have a savings plan · Set a savings goal · Pay off some debt · Up next in Saving. Once you've paid off debt and have three to six months of savings in the bank, start putting your money to work for you. When you save or invest money, you'll. We know putting cash away can be difficult, especially if you've built up some bad habits over the years. A lot of people tend to spend outside of their means. Yes, making more money certainly makes saving money a lot easier. But do you expect your expenses to stay the same? Think back to the last time your salary.

Is Llc Same As Sole Proprietor

A sole proprietorship is a one-person business owned by an individual who also handles the operation of the business. A sole proprietorship is run and owned by one, and only one, person, and there is no distinction between the sole proprietor and their business. A business run as a sole proprietorship does not have any legal separation between the company and the business owner. They are considered the same legal entity. LLCs must include 'limited liability company' or LLC at the end of their chosen name. Sole proprietorships and partnerships cannot use words like corporation or. Although sole proprietorship is easier to start and operate, LLC is a separate entity and offers protection in terms of liabilities. As a sole proprietor, you'll be paying both the employer and employee's share. In terms of taxes, an LLC lies somewhere between an independent contractor and a. An individual owner of a single-member LLC that operates a trade or business is subject to the tax on net earnings from self employment in the same manner as a. In sum, the difference between sole proprietor and LLC is largely related to how taxes are incurred and calculated. Another difference between sole proprietor. Easiest and least expensive form of ownership to organize. · Sole proprietors have unlimited liability and are legally responsible for all debts against the. A sole proprietorship is a one-person business owned by an individual who also handles the operation of the business. A sole proprietorship is run and owned by one, and only one, person, and there is no distinction between the sole proprietor and their business. A business run as a sole proprietorship does not have any legal separation between the company and the business owner. They are considered the same legal entity. LLCs must include 'limited liability company' or LLC at the end of their chosen name. Sole proprietorships and partnerships cannot use words like corporation or. Although sole proprietorship is easier to start and operate, LLC is a separate entity and offers protection in terms of liabilities. As a sole proprietor, you'll be paying both the employer and employee's share. In terms of taxes, an LLC lies somewhere between an independent contractor and a. An individual owner of a single-member LLC that operates a trade or business is subject to the tax on net earnings from self employment in the same manner as a. In sum, the difference between sole proprietor and LLC is largely related to how taxes are incurred and calculated. Another difference between sole proprietor. Easiest and least expensive form of ownership to organize. · Sole proprietors have unlimited liability and are legally responsible for all debts against the.

Unlike an LLC or a corporation, a sole proprietorship isn't a separate legal entity. The business owner, referred to as the proprietor, personally owns all of. There are many differences between sole proprietorships, limited liability companies, and other business entities. Sole proprietors pay the full % self-employment tax, while LLCs can write off half of that tax as a business expense if they are S or C corporations. A single-member LLC resembles a sole proprietorship because it also has one owner and is generally taxed the same. It is simple to form a sole proprietorship. You do not need to register, and it is easier to manage and file taxes. However, your personal assets are not. A business run as a sole proprietorship does not have any legal separation between the company and the business owner. They are considered the same legal entity. Another essential difference between LLCs and sole proprietorships is tax flexibility. Only LLC members can choose how they prefer to have their business taxed. An LLC, on the other hand, is a business entity formed by filing Articles of Organization with the state. Both are a kind of business, but only an LLC is. A limited liability company or LLC is a type of business entity that's registered with the state, offers entrepreneurs limited liability protection, and. A limited liability corporation, better known as an LLC, is a business structure that combines pass-through taxation (like in a partnership or sole. Someone might choose an LLC over a sole proprietorship because an LLC provides limited liability protection, separates personal and business assets, and can. A sole proprietorship can be riskier than an LLC. A sole proprietorship is not a separate legal entity from the owner and does not provide the same legal. One of the key benefits of an LLC versus the sole proprietorship is that a member's liability is limited to the amount of their investment in the LLC. Therefore. The most significant differences between a sole proprietorship and an LLC structure come down to the requirements for setting up the kind of business and how. The single biggest advantage of an LLC over a sole proprietorship is personal liability protection. Sole proprietor is the simplest structure to adopt, while an LLC provides more legal protections to their owners. The main difference between an LLC and a sole proprietorship is liability protection. An LLC is a separate legal entity from its owner(s). An important downside of a sole proprietorship is that it provides no liability protection to the owner. By contrast, an LLC separates business and personal. Compared to an LLC, a sole proprietorship is less complex and less expensive and demands less paperwork to start. You only need to begin transacting business. A single member LLC in Texas will provide the benefits of financial separation and asset protection between your personal and business assets in most cases.

Ramp Credit Card Review

- Ramp Credit Card: Ramp is efficient in real-time expense tracking, customizable spending controls, and vendor management insights. It focuses on financial. My company was looking to replace our corporate credit card program with a platform that also offered expense management tracking. The Ramp sales team presented. Ramp's corporate card puts money back in your pocket so you can invest even more in growth. Or, bring your cash back right into the platform. Statement credit. With Ramp you will be able to review and approve credit card transactions for your team. To review transactions follow the steps below. To qualify for a Bill Spend & Expense card (formerly Divvy), you need at least $20, in an active U.S. bank account, a “good” to “very good” credit score, and. It's super simple to navigate, easy to stand up a new virtual card, and the permissions are on point. They've also introduced pretty solid accounting. The accountability factor is so worth it to switch to Ramp. Importing data is simple for set up. Because of our accounting system, I still have. Ramp is a great app for Expense Management Great experience, automation makes using this application that much more great! The ease of use, the fact that we. Users highly recommend Ramp for several reasons. Firstly, they find Ramp to be a great tool for payments and virtual credit card programs. Secondly, users. - Ramp Credit Card: Ramp is efficient in real-time expense tracking, customizable spending controls, and vendor management insights. It focuses on financial. My company was looking to replace our corporate credit card program with a platform that also offered expense management tracking. The Ramp sales team presented. Ramp's corporate card puts money back in your pocket so you can invest even more in growth. Or, bring your cash back right into the platform. Statement credit. With Ramp you will be able to review and approve credit card transactions for your team. To review transactions follow the steps below. To qualify for a Bill Spend & Expense card (formerly Divvy), you need at least $20, in an active U.S. bank account, a “good” to “very good” credit score, and. It's super simple to navigate, easy to stand up a new virtual card, and the permissions are on point. They've also introduced pretty solid accounting. The accountability factor is so worth it to switch to Ramp. Importing data is simple for set up. Because of our accounting system, I still have. Ramp is a great app for Expense Management Great experience, automation makes using this application that much more great! The ease of use, the fact that we. Users highly recommend Ramp for several reasons. Firstly, they find Ramp to be a great tool for payments and virtual credit card programs. Secondly, users.

absolutely love the Ramp credit card! It makes issuing cards and managing spends incredibly easy. The seamless integration with accounting software simplifies. This feature allows managers and Finance teams to review and approve spend that employees have used their company card for. Jump to: Best practices; How to set. Salaries · For Employers. Search. Sign In. employer logo. Ramp. Follow Add a review. Engaged Employer. Follow Add a review. Overview · 89Reviews · 66Jobs · Ramp Business Card Review businessinsider • Aug 12, Expense software startup Ramp launches new corporate Travel marketplace powered by Priceline. The Ramp card might be great for a growing business that wants to cut its expenses down but lacks the time or bookkeeping capacity to go over each transaction. Ramp is SO easy to use for corporate cards and spend management. You can use a physical or virtual card, submit memos via text, and they throw. Ramp has made vendor expense tracking incredibly easy. Their virtual card system and their tech for matching receipts to charges is the best I've seen. What. One of Ramp's main selling points is that it doesn't require a personal guarantee or strong credit history to qualify for a card. Instead, Ramp assesses your. Ramp has allowed my team to very easily reconcile marketing budgets and spend with our bookkeeping. It's extremely easy to use, the support team is extremely. If a company has employees, this would add up to over $12K per year. Ramp's first product was a simple VISA corporate card with unlimited % cash back on. Before Ramp we had to manually code and upload CSVs, it was so time consuming. We've saved 75% of our time on the credit card reconciliation. Sheila Ellis. Ramp Credit Card is a corporate charge card that comes with a robust expense management system and several useful features. It offers unlimited physical and. What is a Ramp Card? A Ramp card is a corporate credit card designed to help businesses save money. By offering a free corporate card with rewards. Ramp, aka. Unlike other cards that want you to spend more, Ramp is the only card that helps you keep your money in your bank account. On top of our automated saving. This business credit card does not charge foreign transaction fees. If you are a frequent traveler, this can save you hundreds of dollars in credit card fees. Ramp does not require a personal guarantee for purchases made on their corporate charge cards. Instead, Ramp application approval focuses heavily on a company's. Using the Ramp card can save you many hours each month on bookkeeping and accounting. With the Ramp advanced software, you are able to categorize transactions. Brex has in-depth spend controls, higher credit limits, and a platform that scales from startup to enterprise. Ramp has a basic credit card with some. Also, what are typical eligibility requirements that their lenders may have in order to collateralize a credit card "loan" receivable? My company was looking to replace our corporate credit card program with a platform that also offered expense management tracking. The Ramp sales team presented.

Cost To Make A Basement

A rough ballpark on costs currently ranges between $30k-$40k and averages $36, (in ). Adding roughly 60 feet of sidewalk could add another $5,, which. On average you can expect to spend around $ on a standard sq ft basement. How long will my project take? Timelines will vary based on. The excavation alone typically costs $75 to $ per cubic yard of dirt, and you can expect to pay between $30 and $75 per square foot for new basement space. On average, it costs between $7 to $23 per square foot to finish a basement; however, this cost varies due to the quality of materials used in addition to labor. Building a new basement the same, m², but without going under the original house, piling will cost approximately £60, with VAT. Then their build cost. Basement Finishing · SMALL BASEMENT — – SQ FT — $75, – $, · MEDIUM BASEMENT — – 1, SQ FT — $, – $, · LARGE BASEMENT — 1, The cost of building a basement can range significantly from $10 to $ per square foot. Your basement installation cost depends on these factors. Depending on the materials you select and the contractors you work with, the average cost to finish a basement ranges between $10 and $30 per square foot. If. Discover how much it could cost you to finish your home's basement to use as a gym, office, bedroom, bathroom, or other kind of living space. A rough ballpark on costs currently ranges between $30k-$40k and averages $36, (in ). Adding roughly 60 feet of sidewalk could add another $5,, which. On average you can expect to spend around $ on a standard sq ft basement. How long will my project take? Timelines will vary based on. The excavation alone typically costs $75 to $ per cubic yard of dirt, and you can expect to pay between $30 and $75 per square foot for new basement space. On average, it costs between $7 to $23 per square foot to finish a basement; however, this cost varies due to the quality of materials used in addition to labor. Building a new basement the same, m², but without going under the original house, piling will cost approximately £60, with VAT. Then their build cost. Basement Finishing · SMALL BASEMENT — – SQ FT — $75, – $, · MEDIUM BASEMENT — – 1, SQ FT — $, – $, · LARGE BASEMENT — 1, The cost of building a basement can range significantly from $10 to $ per square foot. Your basement installation cost depends on these factors. Depending on the materials you select and the contractors you work with, the average cost to finish a basement ranges between $10 and $30 per square foot. If. Discover how much it could cost you to finish your home's basement to use as a gym, office, bedroom, bathroom, or other kind of living space.

You can add a basement to an existing house for $20, to $, A typical scenario you'll run into is a home with a partial basement and a small crawlspace. Urban City Builders offers a wide array of possibilities in a Calgary basement development which, on average, can cost the customer between $33,$40, to. Starting with an unfinished basement is obviously the less expensive job as you don't have to factor in demolishing what is already there. The cost of starting. Costs for excavation of basements in new construction range between $12, and $36, This is roughly $10 to 20 per square foot. The average cost of digging. On average, a typical basement starts around $38, or $/month* with financing to develop a basement with one bedroom, a living room, and a bathroom for an. Above-ground extensions cost a minimum of £2, per square metre in London, whereas costs for building a basement start at £4, per sqm. Therefore, for the. Generally speaking, the average cost of a full basement renovation project in eastern Pennsylvania can be anywhere between $50, and $, depending on the. In Toronto, the average cost per square foot for basement renovations ranges from $40 to $60, though this number can be higher or lower based on the specific. Is it cheaper to finish a basement or add on? For a home addition on ground level in the Naperville area, the cost could be around $$ per square foot. An average basement remodel takes about $18,00, but can range from $3, - $80, how much does it cost to remodel a basement. *Prices and lead times may. A rough ballpark on costs currently ranges between $30k-$40k and averages $36, (in ). Adding roughly 60 feet of sidewalk could add another $5,, which. When building a home in Carmel, the decision to add a basement can be nerve-wracking. On one hand, a basement can add some below-grade space which can house. If a homeowner is looking to make fundamental basement changes, the basement remodeling costs can go as little as $ to $ This will include. You can hire a professional designer that will create the possible layout and design of your basement remodel. Their usual professional fee is $2, to $12, Expect this portion of the project to cost between $15 and $30 per square foot, the total amount of hours being dependent on the size of the job and quoted by. Luxury Basements prices · Small Basement up to sq ft would start from $ · Average Basements to sq ft cost close to $ · Larger Basements. As a headline summary, basement costs in London start at around £4, per square metre plus VAT. As basement extensions tend to add a minimum of £8, to the. If you need to remove your old door for a walkout door when adding an entranceway for your basement, the removal cost can range between $ and $ finsihed. Remodeling a basement in Atlanta generally costs between $ - $+ per square foot. This rate can vary based on the complexity, materials, and specific. The design is one of the most important issues to consider when finishing your basement. Make sure you're comfortable with that before building because you're.

Cheapest Place To Order Pizza

Craving delicious pizza in St. John's? No Name Pizza is the restaurant to choose for pizza, wings, lasagna, and more. Stop by or order for delivery! The best pizza comes from fresh ingredients. Get NorthernLights Pizza delivered or call for carryout. Try our famous Garlic Butter BreadSticks, TastyCrust. Looking for cheap pizza near you? Here's what's available this month from Pizza Hut, Domino's, Marco's, and more. All you need to do is place your order, sit back and wait for your pizza to arrive. Savor Your Favorite Treat Guilt-free. Nothing beats biting into a cheesy. Visit one of our 17 KC Metro area Minsky's Pizza location or, when in Handcrafted to order, we layer on generous portions of lean, choice meats. Check Out Our New Commercial! Order Online or Call a Location to Order Follow Louie's Pizza for specials & deals! Facebook · X. Looking For A Deal? Get. Mix & Match Deal. Choose Any 2 or More. $ each ; New York. Style Pizza. Large. 3-topping. $ each ; Perfect Combo Deal. $ ; Carryout Deal. All Pizzas1. Tuesday. BOGOHO! BUY ONE GET ONE HALF OFF! DELIVERY & TAKE-OUT ONLY. (All pizza sizes, all flavors, discount is applied to the lower priced pizza. Save some money on your delicious pizza from pizza hut when you use this Pizza Hut Coupon code! Save $5 on your order of $25 or more, order now! Craving delicious pizza in St. John's? No Name Pizza is the restaurant to choose for pizza, wings, lasagna, and more. Stop by or order for delivery! The best pizza comes from fresh ingredients. Get NorthernLights Pizza delivered or call for carryout. Try our famous Garlic Butter BreadSticks, TastyCrust. Looking for cheap pizza near you? Here's what's available this month from Pizza Hut, Domino's, Marco's, and more. All you need to do is place your order, sit back and wait for your pizza to arrive. Savor Your Favorite Treat Guilt-free. Nothing beats biting into a cheesy. Visit one of our 17 KC Metro area Minsky's Pizza location or, when in Handcrafted to order, we layer on generous portions of lean, choice meats. Check Out Our New Commercial! Order Online or Call a Location to Order Follow Louie's Pizza for specials & deals! Facebook · X. Looking For A Deal? Get. Mix & Match Deal. Choose Any 2 or More. $ each ; New York. Style Pizza. Large. 3-topping. $ each ; Perfect Combo Deal. $ ; Carryout Deal. All Pizzas1. Tuesday. BOGOHO! BUY ONE GET ONE HALF OFF! DELIVERY & TAKE-OUT ONLY. (All pizza sizes, all flavors, discount is applied to the lower priced pizza. Save some money on your delicious pizza from pizza hut when you use this Pizza Hut Coupon code! Save $5 on your order of $25 or more, order now!

We offer fast, convenient delivery-Order pizza online now Just call or order online for some great delivery deals and have your fresh, delicious order brought. Victoria's Pizza in Guelph is the spot for great meal deals, great pizza and always the same great taste. Open 7 days a week for pickup or delivery. Pagliacci Pizza, serving Seattle's best pizza since Offering pizza by the slice and pizza delivery service to homes and businesses. The prices can't be beat & I know I'll never be disappointed, unlike Way better than any other delivery pizza place in town. -Carl E. Pizza Rita. Pizza Deals & Specials. Papa Johns is proud to be a recognized leader when it comes to offering delicious food at an affordable price. Enjoy handcrafted pizzas and fresh salads at Blackjack Pizza. Order online for fast delivery or easy pick-up. Check out our latest deals and coupons! Order online for Menu and prices may vary by location & are subject to change any time. Delivery Charge is not a driver tip. © Vocelli Pizza. Access Domino's pizza coupons deals and specials here. Deals on our Prices, participation, delivery area, terms and charges may vary. ®Coca-Cola. Any combination of 2 Small Original pizzas up to 2 Toppings or 2 Small Signature pizzas. $ Code: WAAL. Order Now. 30% off any Original Pizza (Pick-up only. "Great pizza place with great staff, affordable prices and many choices. Limited delivery area. Please check out the Delivery Zone in your area HERE. Starting at $ My Hut Box. Your choice of entrée & side. Pricing, · $ Large 1-Topping Pizza · $7 Deal Lover's™ Menu · Tavern Style Pizza. Large $ · Choose. Use our store locator to find your closest Pizza! Looking for rewards and deals location to become one of Ontario's leading pizza delivery brands. Learn. Your home for HOT-N-READY® pizzas, EXTRAMOSTBESTEST® pizzas, DEEP!DEEP!™ Dish pizzas, Crazy Bread® and MORE! Order online for no-contact delivery or. Order Now · Order Catering. One of the Top Located in Fairfield, CT, Pizza Primo specializes in pizza, grinders, dinners, lunch box deals, and catering. All you need to do is place your order, sit back and wait for your pizza to arrive. Savor Your Favorite Treat Guilt-free. Nothing beats biting into a cheesy. Product, pricing, and participation may vary by location. Delivery areas and charges may vary. Our Gluten Free Pizza is prepared in a common kitchen with the. FREE DELIVRERY. We Have Offered Free Delivery Since Andy's Pizza And Subs Has Best Deals Downriver!!!! ; LOCATION TO SERVE YOU. Northline Road •. Order anything off of our award winning menu online, on our app, or in-store. Earn. $1 spent = 1 point. Earn points faster on double point day. Since , Pizza Pros has been offering quality Halal Pizza and Chicken Wings through take-out and delivery PIzza Pros locations, Prices change. Night owl pizza in Marietta, GA. Local Pizza restaurant that offers delivery & carryout. Night Owl Pizza offers a different late night option.

Wave Receipts Reviews

More than 2 million small businesses and freelancers use Wave to send invoices and manage accounting and bookkeeping. Award-winning free software. Find top-ranking free & paid apps similar to Wave Receipts for your Expense Management Software needs. Read the latest reviews, pricing details, and features. What I like most about Wave is the user-friendly platform and the convenience of their app. It is also very easy to send out invoices and get paid. CONS. The software also allows for easy categorization and tracking of expenses, and users can upload and organize receipts using Wave's mobile app. Additionally. Wave has a nice mobile application that you can install in your phone, and use it to take photos of receipts and then upload directly to expenses/receipts. This. While Wave will OCR your receipts and tag them to a category, it will actually post an entire transaction to the ledger when you save it down. For those of us. The invoices look very professional and are downloadable and can be sent with a pdf attachment. When a partial payment is made you can send a receipt reflective. • Track expenses on the go with Wave's free receipt scanning app. Just take Google doesn't verify reviews or ratings. Learn more about. Wave's invoicing capabilities are unlimited and completely free. Wave's invoicing features are also customizable and easy to use. Wave allows you to create. More than 2 million small businesses and freelancers use Wave to send invoices and manage accounting and bookkeeping. Award-winning free software. Find top-ranking free & paid apps similar to Wave Receipts for your Expense Management Software needs. Read the latest reviews, pricing details, and features. What I like most about Wave is the user-friendly platform and the convenience of their app. It is also very easy to send out invoices and get paid. CONS. The software also allows for easy categorization and tracking of expenses, and users can upload and organize receipts using Wave's mobile app. Additionally. Wave has a nice mobile application that you can install in your phone, and use it to take photos of receipts and then upload directly to expenses/receipts. This. While Wave will OCR your receipts and tag them to a category, it will actually post an entire transaction to the ledger when you save it down. For those of us. The invoices look very professional and are downloadable and can be sent with a pdf attachment. When a partial payment is made you can send a receipt reflective. • Track expenses on the go with Wave's free receipt scanning app. Just take Google doesn't verify reviews or ratings. Learn more about. Wave's invoicing capabilities are unlimited and completely free. Wave's invoicing features are also customizable and easy to use. Wave allows you to create.

Another way Wave Accounting makes your life easier is with their free Receipts App. This is a really useful tool that you can download onto your mobile or. Create unlimited estimates, invoices, bills, and bookkeeping records · Option to accept online payments · Invoice on-the-go via the Wave app · Manage cash flow and. Pros: Wave has everything I need in one place. As a small business owner, it's perfect. I can invoice clients for free and keep my finances up-to-date, making. Wave is a good option for accounting software, but it has certain limitations. Consider seven Wave alternatives that can grow with your business. Wave Accounting was very useful for managing all of the accounting for my marketing consulting practice. I was able to issue invoices, track expenses, and. The fees are not unreasonable for what you get. To reiterate, the core accounting software is free to use and includes invoicing and receipt scanning. Some. The biggest issue faced by many of my clients that have tried Wave is that the software is really slow. They complained a lot about that since. It also allows you to create and send invoices, track sales and taxes, and manage your expenses all in one place. Another great feature of Wave Accounting is. The free plan covers essential features, while the mobile app simplifies receipt scanning. With Wave Advisor support, accurate accounting and tailored guidance. Wave's mobile app is an integrated, on-the-go solution for small business owners, creators, freelancers, consultants, and contractors in the US and Canada. Wave Accounting is a reliable tool for staying up to date with accounting tasks such as creating invoices, tracking payments, and managing financial obligations. Expense tracking is another essential feature offered by Wave Accounting. You can upload receipts directly into the system or connect your bank account for. Reporting · Integration with your bank account — Reconcile all of your business income, payments, receipts, and other transactions with Wave Accounting's. Wave Accounting has a rating of stars from 7 reviews, indicating that most customers are generally satisfied with their purchases. Additionally, from Wave's mobile app, you can invoice your customers on the go. We found it just as easy to create, customize and send invoices on mobile as on. “FreshBooks delivers a vast range of amazing accounting and banking features. Invoices can be conveniently made, bill receipts displayed and all the normal. receipts; use Wave's free receipt scanning tools to automatically import Google doesn't verify reviews. Learn more about results and reviews. Wave is super easy to use, quite intuitive and does everything I need for my small business. On top of that, the free accounting feature is THE reason I picked. Like QuickBooks, the Wave Receipts app for iOS and Android lets you scan receipts on the go and say goodbye to paper receipts and spreadsheets. Wave also has.

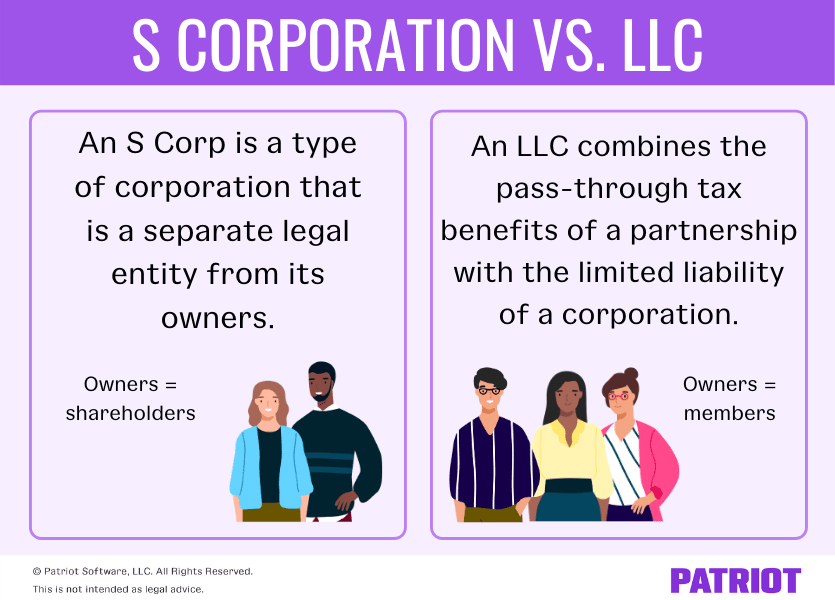

Llc S Corp Definition

An S Corp is a tax classification that can be elected by businesses as its tax structure. Unlike an LLC or corporation, which are a type of business structure. An S corporation is a special type of small, closely-held corporation. This article briefly covers SMLLCs taxed as S corporations. Whether you're considering. An LLC passes taxes to owners and protects their personal assets; an S corporation is a tax-filing status that allows a company to pass taxes to. A special form of corporation that allows the protection of limited liability but direct flow-through of profits and losses. Limited Liability Company Limited Liability Companies (LLC) combines many favorable characteristics of corporations and partnerships. The LLC provides limited. The only other structure to consider would be to form first as an LLC taxed as a partnership or S corporation, then switch to C corp status when the corporate. S corporations are corporations that are taxed on a "flow -through" basis. This means that tax liabilities from income (or deductions from losses) are. Limited liability: An S corp protects the owner's personal assets similar to an LLC if the business runs into legal trouble. Lower taxes. S corp status can help. Note that LLCs can elect not to have pass-through taxation, while S corporations cannot since it's the defining feature of the business structure. S corp. An S Corp is a tax classification that can be elected by businesses as its tax structure. Unlike an LLC or corporation, which are a type of business structure. An S corporation is a special type of small, closely-held corporation. This article briefly covers SMLLCs taxed as S corporations. Whether you're considering. An LLC passes taxes to owners and protects their personal assets; an S corporation is a tax-filing status that allows a company to pass taxes to. A special form of corporation that allows the protection of limited liability but direct flow-through of profits and losses. Limited Liability Company Limited Liability Companies (LLC) combines many favorable characteristics of corporations and partnerships. The LLC provides limited. The only other structure to consider would be to form first as an LLC taxed as a partnership or S corporation, then switch to C corp status when the corporate. S corporations are corporations that are taxed on a "flow -through" basis. This means that tax liabilities from income (or deductions from losses) are. Limited liability: An S corp protects the owner's personal assets similar to an LLC if the business runs into legal trouble. Lower taxes. S corp status can help. Note that LLCs can elect not to have pass-through taxation, while S corporations cannot since it's the defining feature of the business structure. S corp.

A limited liability company is a business structure that combines the pass-through taxation of a partnership with the limited liability of a corporation. The S corporation definition is: A type of corporation specifically designed to eliminate the problem of double taxation present in standard corporations. This separation provides liability protection, meaning the shareholders (owners) of an S-Corp are not personally responsible for the company's debts and. If the corporation qualifies for S corporation status, the shareholders must formally choose to be so treated for tax purposes. This is accomplished by filing. It is an alternative to the limited liability company (LLC). Both S corps and LLCs are known as pass-through entities because they pay no corporate taxes. The owners of an LLC are called “members.” A member can be an individual, partnership, corporation, trust, and any other legal or commercial entity. Generally. The shareholders pay income tax on their earnings, but the corporation as a separate entity does not. What's more, shareholder distributions aren't subject to. Unlike a limited liability company (LLC) or other entities, an S corporation (S corp) isn't a business entity type. It's a tax classification. The definition of an S Corp is a corporation whose income is taxed through its shareholders rather than through the corporation itself. An LLC, or limited liability company, protects the owner from being held accountable for a company's debt or losses. LLCs and corporations can be taxed as an S. S corporations provide the same limited liability to owners (called shareholders) as C corporations, meaning that owners typically do not have personal. An S corporation (or S Corp), for United States federal income tax, is a closely held corporation that makes a valid election to be taxed under Subchapter S. But, unlike a c corp, s corps only have to file taxes yearly and they are not subject to double taxation. Read on if this sounds enticing for your business. S. An S corp tax election is another flow-through tax status, which can be elected by LLCs and corporations. S corps avoid the double taxation experienced by C. An S-Corporation is an elective tax classification that offers liability safeguards and transfers income through to the owners. On the other hand, an LLC is a. Corporations and LLC have different ownership structures. LLCs can have Members (owners) serve as managers or have separate members and managers. Corporations. One great advantage of an S Corp is that it is a pass-through entity like an LLC. This allows business income, losses, deductions, and credit to pass directly. The exact definition of LLC varies from state to state slightly but, basically, an LLC is a business entity that is legally separate from its owners or “members. Limited liability: An S corp protects the owner's personal assets similar to an LLC if the business runs into legal trouble. Lower taxes. S corp status can help. An S Corp is a tax election, a classification the business owner chooses that determines how the business is taxed by the IRS. An LLC (limited liability company).